States With the Lowest Lottery Taxes | Best States to Win the Lottery

American lotteries made history twice over when the Powerball and Mega Millions jackpots grew past $1.5 billion for the first time in 2016 and 2018, respectively. Unfortunately, while lottery jackpots get bigger every year, so do winners’ tax obligations.

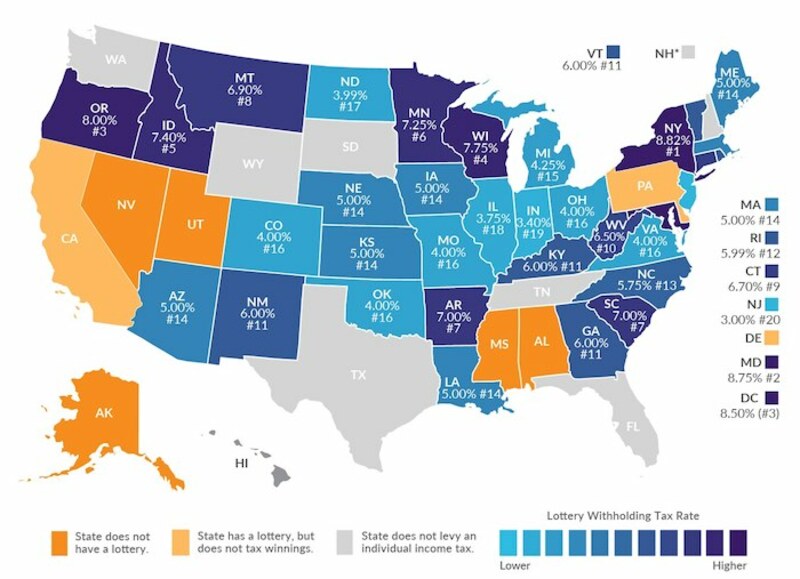

After paying taxes to the federal government, American winners owe local taxes to their state governments too. Taxes on lottery winnings vary widely by state, so where you play is almost as important as what numbers you pick. Keep reading to discover the best states to win the lottery—and where you should think twice about buying a ticket.

How the Federal Government Taxes Lottery Winnings

When you play an American lottery game and win a prize valued at $600.01 to $5,000, the US government expects you to declare your winnings on your yearly tax return as “unearned income” on a W-2G form. Prizes worth $600 or less do not need to be declared.

For American winners, the big tax bills start rolling in for lotto prizes above $5,000. If you’re the lucky winner of a prize this large, you’ll immediately owe the US government 24% of your winnings. Players who win the jackpot will immediately end up in the highest income tax bracket and must pay 37% tax on any prizes above $500,000 for a single winner, or $600,000 for a couple. (International players will have to pay a flat 30% tax on prizes above $5,000.)

Finally, just as they do every year, the government assesses your tax return after you send it in. The IRS will determine if you owe more in taxes or if you are able to receive a refund if you overpaid.

State Taxes on Lottery Winnings

While the federal taxes on lottery winnings are very clear cut, each state taxes income a little differently—and these tax rules apply equally to lottery prizes. This is because cash collected as lotto winnings is considered to be “unearned income.”

States that have the highest income tax rates also tend to tax lottery prizes the most. New Jersey has the highest income taxes in the country, with the top tax bracket currently set at 10.76%. Jackpot winners who bring home a pile of cash in New Jersey would be taxed at this rate.

On the highest end of the tax scale, winners of major prizes are taxed at a rate of 9.85% in Minnesota, 8.95% in D.C., 8.82% in New York, and 8.75% in Vermont. Your home zip code matters too: New York winners who live in the Big Apple or nearby Yonkers will have to pay additional local taxes. Winners in these areas pay a whopping 12.7% in tax on their lotto jackpot—the highest tax burden in the nation. Meanwhile, New York state residents who don’t live in these areas are not charged additional local taxes on their prizes.

The Best States to Win the Lottery

The best states to win the lottery are those that don’t charge any income tax, don’t tax lottery winnings specifically, and those that have the lowest state taxes nationwide. Here they are:

States With No Income Tax

At the time of writing, Florida, South Dakota, Texas, Washington, and Wyoming do not collect income taxes from residents. Any jackpot winners who live in these states will be able to keep every penny of the prize that’s written on their lotto check.

Alaska and Nevada also don’t tax income, but these states don’t participate in American national lotteries. Of course, if you live in these states, you can still get a chance to win the Powerball or Mega Millions jackpots by purchasing tickets online through a reputable lottery agent.

New Hampshire already doesn’t collect tax on salaries and wages, but the state does levy taxes on dividends and investments. This could be inconvenient for lottery winners who want to invest their prize money. However, New Hampshire is in the process of repealing its 5% investment tax and will be completely income tax free by 2025.

States That Don’t Tax Lottery Prizes

California and Delaware specifically do not tax a single penny of your lottery winnings. This probably comes as a huge relief for residents for Californians, since they already pay the highest income taxes in the country.

States With the Lowest Taxes

While the following states do collect income tax from residents, they are the lowest rates in the country. The highest income tax brackets in these states will still allow jackpot winners to keep more of their prizes than they could nearly anywhere else:

- Tennessee*: 1%

- North Dakota: 2.9%

- Pennsylvania 3.07%

- Indiana: 3.23%

- Michigan: 4.25%

- Arizona: 4.5%

- Colorado: 4.63%

- Ohio: 4.8%

- New Mexico: 4.9%

- Illinois: 4.95%

- Utah: 4.95

*Tennessee will be totally income tax free as of January 2021.

How to Protect Lottery Winnings from State Taxes

While there is no way to avoid paying the 24% federal tax on your jackpot prize, even if you live in one of the states without lotteries and buy your tickets elsewhere, it may be possible to shave off some of the state level taxes by taking up residency in a state with low or no income tax.

After winning the lottery, winners usually have one year to collect their prize—though this varies from country. If you can officially transfer your residency to another state before picking up your check, you may be able to lower or eliminate the state taxes on your prize. Wealthy people have been known to set up residency (and businesses) in specific states and countries to cut their tax burdens—and as a newly minted millionaire, you may be able to do the same.

It’s important to note that many states initially tax lottery winners based on the state where they bought the ticket. However, you may still be able to collect your prize in annuities and save on your yearly income tax by moving to a new state. An experienced lottery tax advisor will be able to help you navigate this complex situation.

Conclusion

The state you call home significantly affects how much you’ll pay in taxes and how much of your lotto jackpot will stay in your possession. While moving to a new state—physically or just “on paper”—is always an option, it’s not the only way to save on income and investment taxes.

You may also be able to stay in your current home state and reduce your tax bills using smart money-sheltering tactics. With guidance from reputable tax, finance, and investment professionals, you can make the most of your lottery prize, no matter where you live.